But don't take it from me, take it from the late Sir John Templeton, one of the grandfather-figures of the mutual fund and modern investment industry (I would like to thank my friend and colleague "Jesse" of Jesse's Cafe Americain, who dug this up after I reminded some people of Templeton's comment):

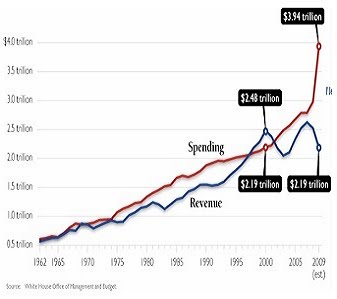

Sir John also had a few words about debt — a four-letter word that folks seem not to care about: “Emphasize in your magazine how big the debt is. . . . The total debt of America is now $31 trillion. That is three times the GNP of the U.S. That is unprecedented in a major nation. No nation has ever had such a big debt as America has, and it’s bigger than it was at the peak of the stock market boom. Think of the dangers involved. Almost everyone has a home mortgage, and some are 89% of the value of the home (and yes, some are more). If home prices start down, there will be bankruptcies, and in bankruptcy, houses are sold at lower prices, pushing home prices down further.” On that note, he has a word of advice: “After home prices go down to one-tenth of the highest price homeowners paid, then buy.”Here's the link to the source for that comment - which was made in an interview with Bill Fleckenstein back in 2003 LINK.

We are edging into the next stage of the popped credit bubble/financial system collapse. The $23 trillion in direct and indirect support flooded into the system since September 2008 by the Fed and Treasury has prevented total devastation. I expect that we'll start see some form of QE2, a further extension and expansion of the homebuyer tax credit program and other goodies which will enable the Big Banks to continue sucking wealth from the Taxpayers via Tim Geithner and Obama's policy implementation.

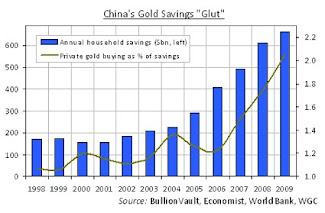

The next leg down will probably be the most painful for everyone because those who are either clinging to the comfort of denial or are hanging on to their home/job/savings by a thin thread, will be brutally affected by what is coming. It's still not too late to unload your home if you have an equity cushion in it and there's still time to accumulate gold and silver before another big move higher - a move that will take many by surprise and shock everyone else who still disparage gold as a "barbarous relic (John Maynard Keynes)." It looks like the only thinking that is barbaric are the theories derived from the originator of that phrase...Got Gold?

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

Dave,

ReplyDeleteIn Florida a property I am looking at buying has gone from $305,000, in 2004, to $106,000 today. A 66% drop and it will probably go lower.

Joe M.

Dave,

ReplyDeleteThere doing it now. Here is a link to Mike Whitney on the mortgages. We are being phucked seven ways to Sunday. Longtime reader - first post - love the blog and keep up the good work.

Gerald

Hey Gerald. Thanks for the feedback! I appreciate it. Please post anytime. Some of the best nformation exchange. comes from these comment diaglogues.

ReplyDeleteIf you get a chance, can you try posting the Whitney link again? If not I'll search for it later.

Joe, unless there's other sharks swimming around, I'd wait until the house folds. Or you could show in an all-cash down-bid. Like $75k all cash with few contingencies other than engineering and environmental inspections.

ReplyDeleteDave,

ReplyDeleteI was thinking the same thing about the all-cash bid because you are the master of the game at this point as in, they can take it or leave it.

OT...The more I think about the GATA whistle blower, the more surreal it becomes. The timing was so perfect it had to be a manna drop from heaven.

Joe M

Maguire was GATA's "deep throat." This story is going to snowball over the weeks and months ahead. My understanding is that there is a lot more information from other sources coming and big media is starting to sniff around.

ReplyDeleteThere was concern over Maguire being properly "vetted," but that hit and run incident is all the "vetting" needed. That says it all right there.

Funny, I always thought you were Fleck (LOL)

ReplyDeleteewwwwww - that's a low blow LOL

ReplyDeleteDave,

ReplyDeleteHere is another try on the link.

http://www.marketoracle.co.uk/Article18356.html

Gerald

I have always seen real estate, for the non "investor", as a long term forced savings plan for those that cannot save by other means. That has all changed and I think the fall out will take years to finally settle out. Good post!

ReplyDeleteMost people will be stunned by how far housing will ultimately fall in value.

ReplyDeletewe have a friend in DC who put (he thought) in a low ball cash offer on a condo--and it was accepted!

ReplyDeletewhoops! if you don't want a bid to get hit in this market, don't make a bid LOL.

ReplyDeleteI just drove thru a noveau rich McMansion neighborhood - everything is big and replaced scraped bungalows - that is adjacent to the old money section of Denver (near the Denver Country Club).

What I saw was absolutely horrifying. On every single block there were an unbelievable amount of "for sale/price reduced" signs. On one block there were 3 brand new construction homes in a row - ostensibly the same builder. Each home was for sale with a "make an offer" sign on top of the "for sale" sign. These are homes that would have sold for $1.5-$2 million a couple years ago. I bet you could own one with $500k all cash, no contingency bid.

the "carry" is a killer-between RE Tax, interest, insurance, maintenance, assn dues, HLP and risk to the property.

ReplyDeleteOne of the trading sayings is that " your first loss is your best loss"

A lot of people now wish they had dropped their price and hit the bid 2 years ago.

Hehe 1- year just hit 4% and Platinum has an ask figure of $1705.50.....sweet.

ReplyDeleteMaybe just maybe with this worthless stack of of relics I have laying around I may be able to buy 2 homes for say 10 relics :)

Hey Dave- You're (literally) hitting close to home now...For what it's worth many of the inner parts of Denver have SO FAR held up nicely...Wash Park / Platt Park come to mind...Cherry Creek is definitely a bit over built with high end stuff that will eventually drop to shape the new market (I think you're totally right about cash offers driving this sector)

ReplyDeleteWe're getting out (have our Denver place under contract) while the tax credit brings the last few buyers to the market. I think the summer selling season will be disappointing with excess supply (sellers encouraged by recent sales activity will flood the market) and few real buyers will appear due to all the demand pulled forward by the tax credit resulting in a buyer hangover for the prime summer season.

Housing remains a bifurcated market...low end / first time buyers are active while anything $417K+ struggles. At the high end there are fewer buyers, even less without a legacy "asset" that they have to deal with before moving up, and significant down payments now required. And something extra to look forward to: the coming interest rate shock for a monthly payment on a $500K home is a lot more alarming than at $200K so I just don't see how housing prices don't have another leg down...in a free market without gov't intervention.

Hey Waterboy. Good move selling into this. Platte Park is starting to slip. I bet it's down 5-10% depending whether it's a bungalow (5%) or a modern home from a scrape. I know someone who unloaded her house 2 years ago (closer to DU than Pearl St.) for $270k and would be lucky to get $230k now.

ReplyDeleteI rent in Wash Park. Brand new construction townhome that was first offered for $700k. The middle unit traded a few months ago for around $575k and now there's a lot supply coming on from projects being finished.

The area to the northwest of Wash Park between Virginia and Alameda, as per a real estate broker, has gotten utterly destroyed.

In general you are right that Denver has held up better than most areas. But I don't see that remaining the case. I'm glad you were able to at least go into contract. Rents are falling, especially with apartments.