“For most of this year during periods of elevated sovereign risk and falling investor risk sentiment, investors tended to move into US Treasuries, which supported the USD. This in turn weighed on gold. More recently, heightened investor risk aversion associated with growing sovereign risk in the euro zone has been supportive of gold. This may indicate that gold’s safe-haven attributes are beginning to trump its currency-hedge attributes. This may be an important development, as sovereign risk until now has acted as a drag on goldprices. If continuing sovereign risk concerns are more likely to elicit stronger safe-haven buying in gold than currency-related selling, then further sovereign risk concerns may be bullish for the bullion market.”It is becoming more readily apparent to anyone observing and participating in the trading/investing of gold and silver that the physical market is beginning to overwhelm the fraudulent, fractional bullion practices of the Big Wall Street Banks. This is a scandal that ultimately looms much larger than anyone realizes and will take gold and silver to prices that will shock even astute, long-time precious metals market participants.

Wednesday, April 28, 2010

Physical Gold Buying vs. Paper Fraud

An unlikely source, given HSBC's well-known manipulation of the gold/silver futures market AND the problems with their physical silver deliveries on the Comex and in London, the gold analyst from HSBC had this say regarding the character of yesterday's gold/silver market:

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

Gold was up against op-ex yesterday and is up again today against a FED announcement. This almost never happens and is indictative that something big is brewing.

ReplyDeleteJoe M.

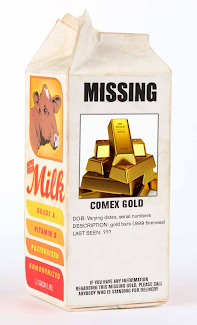

Agree Joe. Two factors: there is a big problem brewing behind the scenes with regard to some big metal holders demanding physical delivery from BNS and HSBC. Apparently the two banks are dragging their feet.

ReplyDeleteAlso, there is clearly a huge amount of physical buying over in Europe - getting out the fiat euro and into physical. I was told by someone in the know that wealthy European buyers are not only demanding proof of authenticity with the LBMA bars they are buying, but they are also demanding delivery OUT of LME warehouses, like HSBC.

" Rolls hands in a mad hatter fashion and laughs out loud "

ReplyDeleteGreat post dave. Yes sir it is going to be one hell of a ride. I am thinking mid July things should really start to heat up...( no punt intended ) :)

Hopium.

Record high again in euro terms yet the majority remain bearish. Sheep always get fleeced....

ReplyDeleteLOL - nice nickname! Just wait until the more of the sheeple in this country start to get a whiff of gold fever.

ReplyDeleteYou have nice legs, by the way.

Dave,

ReplyDeleteAny thoughts as to why gold and silver have been moving in opposite directions to each other the last couple of days?

Good question. Primarily because this is what is known as "roll" week in the futures market. The last day you can hold May silver contracts is tomorrow, unless you fully fund your account for delivery. Since most long positions are speculative funds who have no intention of taking delivery, there is usually heavy selling in the week prior to "first notice" which is this Friday.

ReplyDeleteTypically the gold/silver manipulators (JPM, HSBC, GS, etc) will try to force the market lower during "roll" week, because they know they have a large amount of natural sellers.

In fact, it can be argued that silver is performing much better than usual right now and I think because it seems that a large number of the longs are rolling forward to the next front-month, which is silver.

Typically in the past, on a day like today during roll week when you wake up and silver is getting hammered, it just stays down. Silver has been bouncing back all during the last trading week.

Dave, where did you get this quote from?

ReplyDelete"Just imagine what would happen if a mere ten percent of the money currently going into bonds were instead to go into gold. As in 1972, the real move has yet to begin."

Do you have a link to the article? Thanks!

Here ya go:

ReplyDeletehttp://www.gata.org/files/PollittMarketLetter-04-19-2010.pdf

I sense a distinct possibility of QE from the ECB.

ReplyDeleteNice for gold.

ECB and the Fed. Let's not forget that the U.S. is in much worse shape than Europe.

ReplyDeletehttp://jsmineset.com/2010/04/28/in-the-news-today-527/

Becky Quick said...

ReplyDeleteRecord high again in euro terms yet the majority remain bearish. Sheep always get fleeced

Ohhhh, Becky,... lemme see your 'fleece', girl!!

LOL - I always figured she removed the fleece

ReplyDeleteHow many plates can they keep spinning at one time?

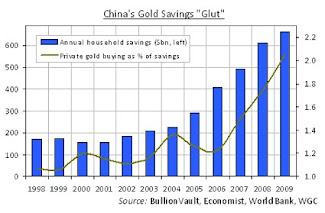

ReplyDeleteI love how the unintended consequences are piling up. It seems every manipulation just complicates things further, making the eventual implosion even greater. (Attack the Euro through CDS and the like, get the ratings agencies on board too! OOPS! Europeans want even more gold - never saw that one coming!)

Dave I sure appreciate your blog and the way you respond to posters regularily. Its a daily fix.

Thanks for the feeback Murray!

ReplyDeleteGreat observation on the unintended consequences effect.

To me the great unknowable unknown are the coming blow-ups in those $T of derivatives and swaps sitting on PMs and interest rates, that will be activated somewhere along the road.

ReplyDeleteDifficult to get a handle on, I guess.

One of the best blogs on the web. Keep up the good work.

ReplyDeleteBill Clinton Is Now a Gold Bug

ReplyDeleteFile this under unexpected. Former President Bill Clinton blames the current financial crisis on the U.S. leaving the gold standard.

During an interview conducted at the Peterson Institute by Bob Schaeffer, Clinton sounded like a hardcore gold bug as he said that the problems in the economy started when the U.S. went off the gold standard.

He then hedged a bit and justified the U.S. leaving the gold standard for "economic management" reasons.

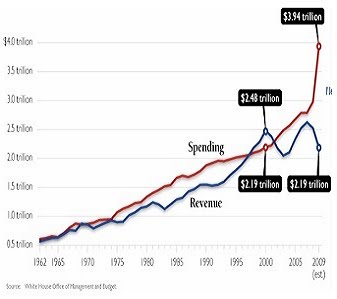

Those economic management reasons were, of course, that the U.S. had printed so many dollars at the then price of gold ($35 per ounce) that the U.S. did not have enough gold to back up all the money it printed. But Clinton's statement clearly implies that he understands that gold is a check on out of control government printing of money.

Do you think Bill and Hillary have a few gold coins tucked away?

On another note, during the same interview, Democrat Clinton makes clear that he doesn't think the SEC has a case against Goldman Sachs. "I read a lot of material on this," he says.

The first roughly two minute of this clip are priceless, at 1:58 get a load of Bob Schaeffer's face, just after Clinton says leaving the gold standard was the problem. The clip is here.

http://www.realclearpolitics.com/video/2010/04/28/bill_clinton_timing_of_goldman_sachs_suit_is_suspect.html

@Anonymous/derivatives - totally agree and I think the Fed is busy monetizing what they can. I would bet U.S. banks have a huge off-balance-sheet derivatives exposure to Greece/PIIGS

ReplyDelete@Anonymous re: my blog. Thanks for the feedback - really appreciate it.

ReplyDeleteHopium - great find! Thanks for posting

ReplyDeletehttp://www.guardian.co.uk/business/2010/apr/29/mervyn-king-warns-election-victor

ReplyDeleteThis is why steps in the UK will be as little as possible.

More risk from interest rate vigilantes, and wasted decades.

thanks for the link. things are ugly in the UK but being used as more "cover" for the even worse state of condition of the U.S.

ReplyDeleteDave,

ReplyDeleteA friend of mine runs this blog in the UK. It has many US contributors

This is a current article on Greece, (from a US contributor)

http://www.marketoracle.co.uk/Article19029.html

He also writes himself, here is his home page with a summary of his own articles.

http://www.walayatstreet.com/

As you can see, both sites are well visited.

Hope it is some interest to you. :-)

Oh ya, Nadeem Wayalat - he does good work, although I think - and I'm not alone in this assessment - that John Mauldin is the "People" magazine equivalent of financial analysis and commentary.

ReplyDeleteThanks for the link to Wayalat's blog.

Thank you so much for sharing the details with us.

ReplyDeleteThe bottom line question in my mind is how much longer the USD can last.

ReplyDeleteJoe M.

A lot longer than we all probably believe. Here's what I think happens: one day we wake up and OPEC and others say "no mas" to selling us their goods for dollars. They'll say we have to exchange the dollars in yuan or yen or something. At that point the dollar drops 50%. Eventually the U.S. issues a "two-tier" currency. One backed by gold that is used for global trade. The other is to be used exclusively inside the borders. Something along those lines...

ReplyDeleteGet Prepared For Massive Gold Launch

ReplyDeletehttp://www.silverbearcafe.com/private/04.10/launch.html

Physical gold is a reasonable investment right now based on 1) sovereign defaults 2) shortages of physical deposits 3) the dollar 4) central banks etc.

ReplyDelete