Just a quick update and follow-up on my recent housing commentary. I'm sure everyone saw that the Case-Shiller 20 metro area home price index dropped 1.1% on an unadjusted basis on a trailing 3-month basis for December vs. November LINK. The overall index is back to its 2002 level. I remember in 2005 telling people that home prices in general would eventually revert back to early 1990's levels (before the Clinton/Reuben/Greenspan strong dollar/money inflation policy was implemented) and I was laughed at heartily. A couple years later I decided we could well see 1981 levels, which are really the same as early 1990's levels (a boom/bust in between fueled by S&L money fueled by Drexel junk bonds). I'm still good with my forecast.

On another note, I had made the observation that banks were dragging their feet on foreclosing on underwater McMansions financed with jumbo loans. The reason for this is that once a big home is foreclosed, either the bank will have to price it to move and take a huge hit to its tier-1 capital or the bank will sit on home and try to minimize losses, but will have to pay for the high taxes and maintenance. Either way it's a huge cost to the bank vs. small homes that can be flipped without hurting the bank's capital on a relative basis (we also know that banks like Bank of America and Wells Fargo have stuffed Fannie Mae and Freddie Mac with a lot of the troubled conventional mortgages - and some jumbos). Ironically, the Wall Street Journal published an article about this: LINK (requires a subscription for the whole article, but you can cut and paste the headline in a google search bar and get "free pass" to view the whole article).

For anyone freaked out by the big hit in the metals today, please be aware that the action did not start until Bernanke was in front of Congress with the Fed's formerly known as the semi-annual Humphrey Hawkins testimony. He issued a comment that the Fed was evaluating "mixed" signals about the strength of the economy and pointed at the recently announced 8.3% unemployment rate as his "evidence" that the economy may be stronger than we think LINK. The market of course took this as a "QE3 is off" signal and immediately sold off gold and especially silver. Forget about the fact that today is first notice day for March silver on the Comex and typically when there's a big slug of open March contracts around delivery time, the price of silver seems to coincidentally sell off hard. Move along, nothing to see there.

But let's examine Bernanke's view that the unemployment rate is signalling potential economic strength. Anyone buy that? Quite frankly, given the overwhelming avalanche of articles and blogs which have very openly dissected the BLS employment report for what it is, it is hard to imagine that Bernanke does not know the truth about the validity of the BLS report or the truth about the true employment conditions in this country. Even the more comprehensive BLS report that gets buried by the media shows unemployment running at over 15%. And it's not really improving. So I have to conclude that Bernanke is either some kind of idiot savant with some kind of "Rain Man" type skill that enabled him to become an economics professor and then Fed head, and therefore has a primarily functionally retarded brain, or he's lying to us. As much fun as it is to speculate on and discuss the former, if I had to bet I would bet on the latter. And therefore his comment about the economy was issued as means of using the Fed's power to jawbone the markets, which was perfected by Greenspan and used effectively Bernanke for nearly 6 years.

Finally, Fannie Mae and Freddie Mac are becoming what I said they would become two years ago when the Obama Government decided to let the Taxpayers become the financiers of the housing bubble: a bottomless pit of losses and endless cost to the Taxpayers. Please note that most of the paper sitting on the balance sheet of these two catastrophe's was sourced, ultimately, by mortgage brokers and big banks. There was no regard for credit standards and trillions in fraud perpetrated. It was the ultimate example of the moral hazard fostered by Government intervention.

Fannie reported its latest quarterly results LINK and, no surprises here, posted a $2.4 billion loss and requested another $4.6 billion of Taxpayer money. I don't get it. The math doesn't add up. How can it lose $2.4 billion but need another $4.6 billion? Where's all that cash flow going? I'd sure love to know. In fact, I'd love to see an independent audit and study performed by an accounting firm with NO ties to the big banks. The politicians and big banks will never agree to that, as they would rather see a meteor hit Southern California and destroy some of the evidence - like a meteor that seems to have hit and destroyed any money wire traces and emails connected to MF Global.

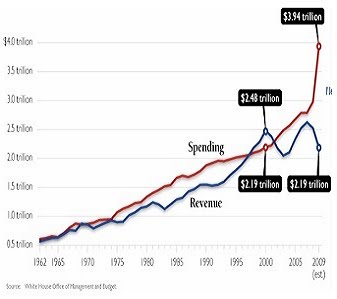

The cost of bailing out both Fannie and Freddie - so far, mind you - is over $152 billion. Just three months ago, the Federal Housing Finance Authority issued a new estimate for total cost thru 2014 would be $124 billion LINK. I don't even know what to say about that. Theatre of the Absurd at its finest. Back in June the CBO issued a statement that said the true ultimate cost of bailing out FNM/FRE would be $317 billion. That's still absurd. I originally said the cost would run into the trillions. I stand by that estimate. For now I'll just say over $1 trillion.

Anyone still think the Government can fund it's operations without massive QE3? E tu, Ben?

Wednesday, February 29, 2012

Subscribe to:

Post Comments (Atom)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)

banana republic...future generations will look back shaking their head at the utter idiocy of this all...ah, then again, how people talk about let alone remember or even know about collapses in monetary systems...the mantra of many at the top is and has been to pillage the earth for why not? Won't be around to see the consequences while their hunger for power and paper money is fed. And even if they are around to see the collapse, enough wealth has been pillaged to ride out the storm.

ReplyDeleteThe cost of bailing out "Foney" and "Fraudy" is infinite IMO.

ReplyDeleteThe mortgage market only exists in it's current form because of these two. The old saying "it works until it doesn't" is most apropos in this situation.

BTW the cost that we are given is what we are allowed to see. I'm certain (like the $750b for TARP-again what we were told first)) that it's MUCH higher by now.

Geithner Is A Criminal! So How Is It He COULD Face Criminal Charges?

ReplyDeletehttp://www.youtube.com/watch?v=QXO5bElqnqg&feature=youtu.be

Great work Dave.

ReplyDeleteA level head in a shitstorm of panic.........

Great post Dave...

ReplyDeleteMortgage rates are varying regularly as compare to other interest rates. Pay attention to trends and keep in mind those present mortgage rates changes frequently. Instead of trying to pinpoint a day when the mortgage rate is at its lowest, ensure how the rates vary from one day to the next.